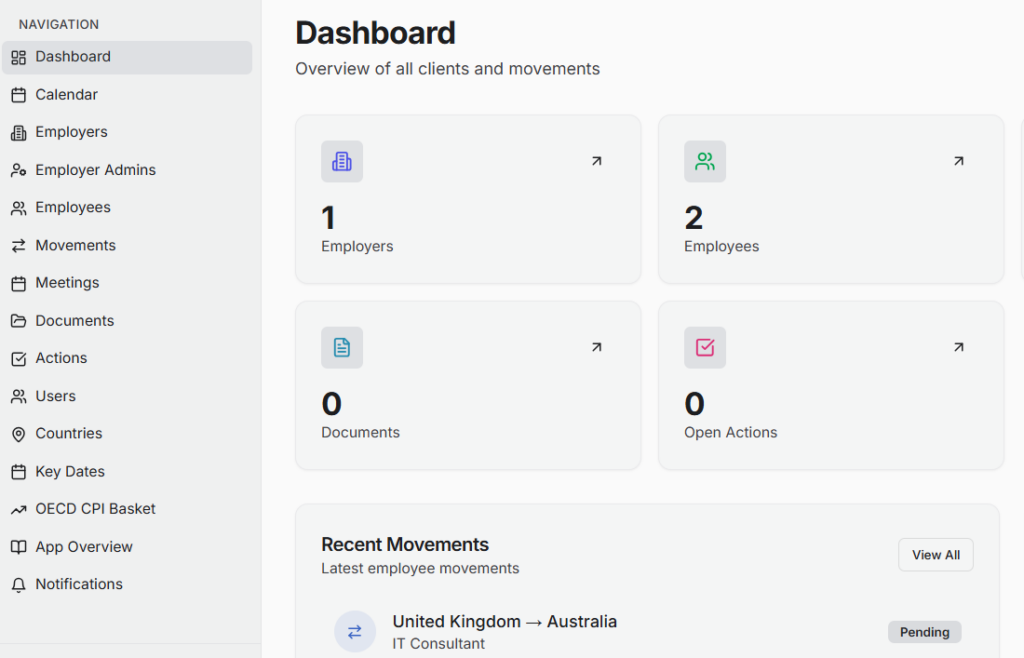

Our proprietary SAIL Secondment App provides:

- Logging of new international assignments

- Key tax & immigration date reminders

- Record of advice provided to employer and employee

- COLA tracking

- Assignment timeline dashboard

This gives HR and Finance:

📊 Visibility

🗂 Structure

⏰ Deadline control

📁 Centralised documentation